the impact of stress tests on bank lending|frb stress test results 2023 : agency Stress tests convey information about the strictness of future tests, creating incentives for banks to alter their future lending behavior. Regulators recognize and use this . WEBJILICC Gaming authorized by PAGCOR. In addition to Live Baccarat games, JILICC Gaming also provides many Sports Events and Slot games

{plog:ftitle_list}

鲨鱼瞄准镜. 发表于 四月 4, 2023 | 经过 行政. 在竞争激烈的在线扑克世界中, 获得超越对手的优势至关重要. 这就是Sharkscope, 在线扑克社区中强大的工具, 发挥作用. 被誉为最全面的单桌和多桌扑克锦标赛统计在线数据库, Sharkscope 成为扑克爱好者不可或缺的 .

This paper examines the impact DFAST has had on bank behavior. Specifically, it studies the effects of stress-testing on banks’ portfolio allocation, including the effects on financial stability risk, credit supply, and borrowers’ investment.confidential Federal Reserve stress test results as a benchmark to banks’ stress . We use an expansive regulatory loan-level data set to analyze how the portfolios of the largest US banks have changed in response to the Dodd-Frank Act Stress Test . Stress tests convey information about the strictness of future tests, creating incentives for banks to alter their future lending behavior. Regulators recognize and use this .

As in 2009, the tests look at the effects of a severe economic downturn on banks’ capital—their ability to absorb unexpected losses and continue to lend, avoiding sharp cut backs in credit that.These results highlight a macroprudential effect of stress-testing: Credit growth is curtailed during a credit expansion in those banks holding a portfolio that is more sensitive to stressful . In a new study, we examine the impact DFAST has had on bank behavior. Specifically, we study the effects of stress-testing on banks’ portfolio allocation, including .

Stress tests are most useful when customized to reflect the char-acteristics particular to the institution and its market area, and can be used to evaluate credit risk in the overall loan .A detailed analysis from Gambetta et al. show that the efficient risk management, large loan portfolios and higher levels of profitability allow banks to reduce the impact of stress tests. .confidential Federal Reserve stress test results as a benchmark to banks’ stress test results, and then analyze the effects of the shock on originations, pricing, credit usage, and performance of .

stress testing in banks pdf

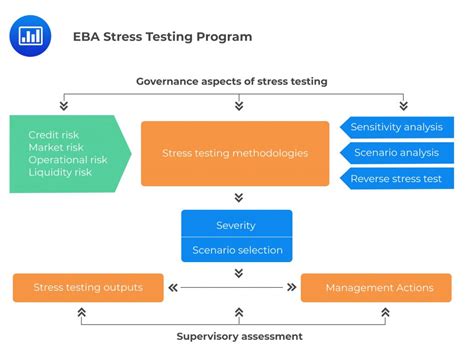

We use an expansive regulatory loan-level data set to analyze how the portfolios of the largest US banks have changed in response to the Dodd-Frank Act Stress Test (DFAST) . This paper investigates the impact of the European Banking Authority (EBA)'s supervisory stress tests on bank lending. Using a sample of 282 European banks over the period 2006–2018, we find that stress-tested banks experience higher credit risk and reduce lending for specific loan types. A bank stress test is an analysis to determine whether a bank has enough capital to withstand an economic or financial crisis. Bank stress tests were widely put in place after the 2008 financial .

identify the impact of supervisory stress tests on the availability of credit to small businesses by analyzing differences in small business loan growth at banks subject to stress tests versus those that are not. Our results indicate that the U.S. stress tests are constraining the availability of small business loans We investigate the effects of the announcement and the disclosure of the clarification, methodology, and outcomes of the U.S. banking stress tests on banks’ equity prices, credit risk, systematic risk, and systemic risk. We find evidence that stress tests have moved stock and credit markets following the disclosure of stress test results.

impact test si units

The Dodd-Frank Act, enacted in 2010 in the wake of the Great Recession, introduced mandatory stress-testing for the largest U.S. banks. Dodd-Frank Act Stress Testing (DFAST) was intended to ensure that banks have sufficient capitalization to absorb the losses they may experience in an economic downturn and, more importantly, continue providing .Stress tests for macroprudential purposes (focusing on financial stability and system-wide effects rather than individual banks) In addition to the above, specific stress tests can also be carried out on individual banks or groups of banks. Annual stress tests. EU law requires the ECB to carry out stress tests on supervised banks at least once . To quantify the impact of the stress tests on lending, we compare the capital implied by the supervisory stress tests with the level of capital implied by the banks' own models, a measure we call the capital gap. We then study the impact of the capital gap on the loan growth of BHCs subject to supervisory or bank-run stress tests.Finally, we analyze the effects of stress-testing and portfolio sensitivity to macroeconomic scenarios on credit supply. Our findings indicate that banks that experience worse results in the stress tests cut lending relative to their peers and specifically in loans that are most sensitive to the stress-test scenarios. At the borrower level .

Banking stress tests assess how banks can cope with severe economic scenarios. We look at banks’ resilience, making sure they have enough capital to withstand extreme shocks and are able to support the economy. . EIOPA conducts biennial stress tests to help scale the impact on insurance companies of the crystallisation of various economic . Finally, we analyze the effects of stress-testing and portfolio sensitivity to macroeconomic scenarios on credit supply. Our findings indicate that banks that experience worse results in the stress tests cut lending relative to their peers and specifically in loans that are most sensitive to the stress-test scenarios. At the borrower level . The Japanese banking crisis provides a natural experiment to test whether a loan supply shock can affect real economic activity. Because the shock was external to U.S. credit markets, yet .

The differences in results are novel to the literature on the effects of stress testing on bank lending for UK banks, as we find that certain stress testing frameworks can have an influential impact on banks, which largely depends on methodological differences. Hence, we can conclude that the BoE stress testing framework has had a noteworthy .

lending, risk-taking, and pro tability. In our study three main ndings are established. Abstract The U.S. bank stress tests aim to improve financial system stability. However, they may also affect bank credit supply. We formulate and test opposing hypotheses about these effects. Our findings are consistent with the Risk Management Hypothesis, under which stress-tested banks reduce credit supply−particularly to relatively risky borrowers−to . The effects on firm loan volumes are larger, when we look at the loans that firms obtain from banks subject to stress tests. A firm that borrows from banks that on a weighted-average basis face a 1 p.p. larger stress-test capital buffer, experiences a 4 p.p. lower rate of growth in utilized loans and a 3 p.p. lower rate of growth of committed . A bank stress test is an exercise that helps bank managers and regulators understand a bank’s financial strength. To complete the test, banks run what-if scenarios to determine if they have sufficient assets to survive .

stress tests impact banks’ C&I lending an d firms’ C&I loan volumes, overall debt, investment spending, and employment. We find that larger stress -test capital buffers lead to material reductions in bank C&I lending. A 1 p.p. larger capital buffer results in a 2 p.p. lower (four-quarter) growth rate of utilized Finally, we analyze the effects of stress-testing and portfolio sensitivity to macroeconomic scenarios on credit supply. Our findings indicate that banks that experience worse results in the stress tests cut lending relative to their peers and specifically in loans that are most sensitive to the stress-test scenarios. At the borrower level .

their lending, and stress tests create a direct link from bank lending risk to capital.2 This Commentary discusses new research that assesses the impact that stress tests have had on small-business lending (Cortés et al., forthcoming). We show that the banks most affected by stress tests reallocate small-business credit awayStress testing is a forward-looking quantitative evaluation of stress scenarios that could impact a banking institution’s financial condition and capital adequacy. These risk assessments are based on assumptions about potential adverse external events, such as changes in real estate or capital markets prices, or unanticipated deterioration in .

Box A: The Bank’s approach to stress testing. Each year, the Bank usually carries out a stress test of the major UK banks that incorporates a single severe but plausible adverse scenario. footnote [1] The Bank’s usual annual stress test – the annual cyclical scenario (ACS) – seeks to stress major UK banks at the same time against a single hypothetical .

Post-crisis stress tests have altered banks’ credit supply to small business. Banks affected by stress tests reduce credit supply and raise interest rates on small business loans. Banks price the implied increase in capital requirements from stress tests where they have local knowledge, and exit markets where they do not, as quantities fall most in markets where .

In this paper, we study the effects of supervisory stress test exercises on 19 UK banks over the 2005–2018 period. The novelty of our approach is that we include two stress testing timelines from two banking supervisory authorities. Using a difference-in-difference methodology, in a first step, we analyse the effects of the Bank of England’s stress tests on . Stress tests convey information about the strictness of future tests, creating incentives for banks to alter their future lending behavior. Regulators recognize and use this influence: they may conduct softer stress tests to encourage lending or tougher stress tests to reduce risk-taking. This information management can lead to inefficiencies when (a) the test . [1] Financial regulators are strongly encouraging regional and community banks to conduct stress tests and develop actionable plans to mitigate these risks. Developing meaningful loan portfolio stress tests. Stress testing is a process that evaluates the potential impact of adverse economic scenarios on a financial institution’s portfolio.

stress testing framework for banks

The U.S. bank stress tests aim to improve financial system stability. However, they may also affect bank credit supply. We formulate and test opposing hypotheses about these effects.

We also provide evidence that the publication of stress test results enhanced price discrimination as the impact on bank CDS spreads and equity prices tended to be stronger for the weaker .

impact test sieve shaker

impact test sieves

Resultado da 11 de dez. de 2015 · Steve Carell plays Mark Baum and Ryan Gosling plays Jared Vennett in The Big Short. Director Adam McKay says, "One of my .

the impact of stress tests on bank lending|frb stress test results 2023